aurora co sales tax license renewal

To apply for a standard sales tax license complete the Colorado Sales Tax Withholding Account Application CR 0100AP. Anyone who sells at retail in Colorado without obtaining a sales tax license commits a class 3 misdemeanor and may also be subject to a civil penalty of 50 per day to a maximum penalty of 1000.

Ad Apply For Your Colorado Sales Tax License.

. Parks and Recreation Maps. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Police and Fire Maps.

This number can be found on your business license certificate. Excise Fuel Tax. Do you need to submit a Renewal Application For Sales Tax License in Aurora CO.

Annually if taxable sales are 4800 or less per year if. Be sure to include a check or money order with your renew. Planning and Zoning Maps.

Peddlers All peddlers must be registered with the City of Aurora. 303-739-7057 RENEW NOW With this service businesses can renew their license to operate in Aurora city online. Aurora is Colorados third largest city with a diverse population of more than 381000.

For example a new account a sales tax license for one physical location would be a total of 66. 800 805-9145 email protected Sales Affiliates and. To register to peddle non-food andor non-drink items contact the City Clerks Office at 630-256-3070.

You will need your business license account number to access this service. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Do you need to submit a Tax Registration in Aurora CO. Two years from date of issuance. To obtain a sales tax license please complete the registration process on MUNIRevs and submit the 3500 fee.

29 RTD salesuse tax. 1-800-870-0285 email protected. Ad New State Sales Tax Registration.

Wayfair Inc affect Colorado. Unlimited phone and online support is available Monday through Friday from 9 am. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue.

The City of Auroras tax rate is 8850 and is broken down as follows. There are a few ways to e-file sales tax returns. Each physical location must have its own license and pay a 16 renewal fee.

The 50 deposit will be refunded automatically after a business has collected and paid 50 in state sales taxes. The County sales tax rate is. An Aurora Colorado Tax Registration can only be obtained through an authorized government agency.

All services are provided electronically using the licensing portal. For additional Sales Tax Licensing information refer to FYI Sales 9. Colorado state salesuse tax.

Initial License FeeRenewal License Fee. Find out with a business license compliance package or upgrade for professional help. If you have more than one business location you must file a separate return in Revenue Online for each location.

This is the total of state county and city sales tax rates. The Colorado sales tax rate is currently. Specific Instructions Verify the information on this application is correct.

1-800-870-0285 email protected Customer Service. If you are requesting a new account there is a 50 deposit that must be remitted with the Colorado Sales Tax Application CR 0100AP. Sales Use Tax.

Tax Education Training. Renewed licenses will be valid for a two-year period that began on January 1 2020. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. 11 Adams County sales tax due only if purchased from another Adams County resident or a dealer located in Adams County. City of Aurora 250.

245 W Roosevelt Road West Chicago IL 60185 This office is open Monday through Friday 830 am. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Because of the different cities and taxing jurisdictions within Adams County the sales tax rates will vary.

Sales taxes are based on the vehicle purchase price. For additional e-file options for businesses. Mayor City Council.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Aurora Colorado Tax Registration. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Administration of Education Programs 2 Administration of General Economic Programs 2 Administration of Housing Programs 1 Administration of Public Health Programs 7 Administration of Urban Planning and Community and Rural Development 1.

The Aurora sales tax rate is. Did South Dakota v. Licensing and Permits Maps.

Find out with a business license compliance package or upgrade for professional help. AD AD Community QA You can ask any questions related to this service here.

City Of Stockton Transit Oriented Development Tod Housing Tools

News Flash Chesterfield County Va Civicengage

Illinois Realtors Honored For Their Commitment To Rpac At Nar Legislative Meetings Illinois Realtors

The Chamber S 2021 Business Directory By Aurorachamber Issuu

Alexander Gonzalez Bba Manager Of Mortgage Operations Habitat For Humanity Of Metro Denver Linkedin

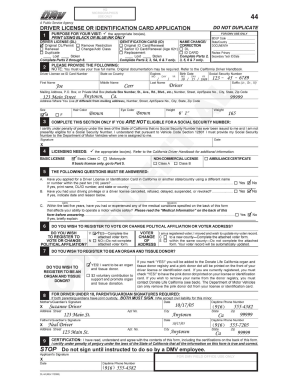

Dl 44 Form Fill Out And Sign Printable Pdf Template Signnow

Renew Your Sales Tax License Department Of Revenue Taxation

Illinois Realtors Honored For Their Commitment To Rpac At Nar Legislative Meetings Illinois Realtors